JENNIFER HALEY, CPAHi there, I'm Jennifer Haley, CPA. I'm here to help business owners get a handle on their finances so they can get back to doing the things they love. Categories

All

Archives

January 2022

|

Back to Blog

Wow, you actually clicked on this post, I am so excited! Now I'm going to cross my fingers and hope I can keep you here and have you equipped with the tools to complete your budget and use it as a guide through life. You may have heard me say before but if not, I actually HATE the word budget. Every time I hear that word I instantly want to fall asleep (it's like I'm being dragged into Sears in the 90's with my Mom 😴). Instead you'll hear me instead use the terms Financial Purpose or Intentions! These words are much easier to digest; and c'mon they just feel lighter and exciting! I'm going to start by writing out the steps for you to follow in creating your financial purpose. Do one step at a time and feel free to do one step a day or do them over a period of a week or two. This can become very overwhelming and the last thing you want to do is give up; so stick with me and be gracious to yourself. Step 1 - The Gather Gather 1 month of all of your bank/credit card statements. It doesn't have to be this month or even last month. I actually recommend picking a month that would be the most realistic picture of your spending habits (Eg not December when you are in the Christmas rush and not January when you are reining in on your spending). Extra Tip: Gather 3 months of your statements (the months don't need to be in order). We will work with an average below for an even more accurate reflection. What you will need for the next steps:

Step 2 - Calculate your Income At the very top of one of the pieces of paper write My Financial Purpose; then write one quick financial intention, the reason you are doing this! Come back to this as you start to get overwhelmed or board, it will help keep you focused. Next, under your financial intention but towards the top of the page write down your total monthly income. If you are paid bi-weekly, assume 2 pays in a month (we will deal with the 2 times you get 3 pays at another time) this is the benchmark we will use for creating your financial purpose as it is the most stable cash flow mark (ie 10 months out of 12; as in 10 months out of 12 you do get just 2 pays). Okay, so you may have done the first 2 steps at once, they are pretty light. You may want to step away and come back in a bit, or if you are feeling head strong, lets push on to step 2. Step 3- Fixed Expenses It is time to lay out those statements; one statement at a time (if you decided to party earlier and grabbed 3 months of statements, we will start with one month and then you will do this process for the other 2 months). Let me guess your eyes are glossing over as you run through those transactions in your statements. Stay with me here, we are going to focus on just your fixed expenses. These are the expenses that happen automatically each month and don't fluctuate often; like your mortgage payment (not your groceries) Using one highlighter color (if you have multiple), highlight each of these types of items. Once you have done this with all of your statements total all of your highlighted items and list this under your income as your fixed expenses. If you have 3 months of statements average the total of all 3 months. Extra Tip: We are going to include your debt minimum payments as a fixed expense, check you line of credit, credit cards, etc for minimum payments and add these in the totals. We will look at paying off your debt later but right now we just want to figure out what you have to pay regardless. Step 4 - Variable Expenses It's time to pull out the rest of your highlighter colors. If you don't have one that is okay, your finished art piece just won't have as much flare :) Now we are going to focus on the rest of your expenses (aka the remaining transactions that aren't highlighted). You are going to highlight and group the rest of your expenses in categories, some common categories are:

Once you have categorized each expense, total up all of the expenses for each category; list this below your fixed expenses on your piece of paper. You got through it, you got through the worst part of it all (well in regards to work!). Take a break, you deserve it. Go walk the dog, have a coffee or binge watch Emily in Paris. Just let you mind breath because the next step might be hard to digest and I want you to be strong as you tackle it. Step 5 - Calculating your Current Situation I hope you enjoyed your walk. Or maybe it's been a few days because I told you about Emily in Paris 🇫🇷 and now you are obsessed. This step is quick, but usually packs the biggest stomach punch. Are you "living within your means" or are you slowly increasing your debt position. Take your income total and subtract your fixed expenses and then subtract your variable expenses.....your answer, does it have a dash in front of it? If there is a dash, don't panic, this is the exact reason we are doing this exercise, to figure out where, what, and when you should be spending to create your Financial Purpose! I'm assuming you know if you have a positive number than it means you have extra money each month, as in you are not spending more than you are earning. If you have a negative number here, then you are spending more than you are earning in income. In the next step I will go through how to manage your deficit and even your surplus. Step 6 - What Next *Add note about annual expenses

0 Comments

Read More

Back to Blog

JOIN OUR TEAM!9/21/2021

Back to Blog

VALENTINE'S ON A BUDGET2/5/2021

Back to Blog

*NEW* T4 REQUIREMENTS!2/2/2021 As we all know, 2020 was a year we will all never forget and brought along a lot of changes for everyone!

Well now CRA has made changes to the T4 slip that are required to be applied by ALL employers to assist CRA validate payments under the Canada Emergency Wage Subsidy (CEWS), Canada Emergency Response Benefit (CERB), Canada Emergency Student Benefit (CESB). For the tax year 2020, in additional to the normal boxes, you must complete the following codes for each employee:

For more information, visit CRA's bulletin!

Back to Blog

GOAL SETTING1/20/2021 Goal setting can be intimidating and overwhelming, I find the biggest reason people don't set goals is because they truly don't know how to set goals. Below is a framework on how I create my goals :)

BRAINSTORM Set a timer for 5 minutes, imagine that this piece of paper is your wish fairy and everything your write down WILL come true. Think of what your ideal life is if you could literally do anything, think of this paper as the list of how you will make that happen.

REVIEW Review all of the goals you have written down and narrow down your list to what you believe is your truth and what must happen for you.

PUT IT ON PAPER Write each down each goal from above leaving space for further detail. ACTION PLAN & MAKE IT MEASURABLE Create your action plan for each goal by ensuring it is SMART (Specific, measurable, attainable, realistic, timely).. Write out:

VISUALIZE IT Begin the work on your vision board!

TAKE ACTION!!! Lastly and most important, take action on your goals! Use your goals to help you make decisions in your day to day life, and then CELEBRATE any and all of your successes, no matter the size! Jennifer H. Xo

Back to Blog

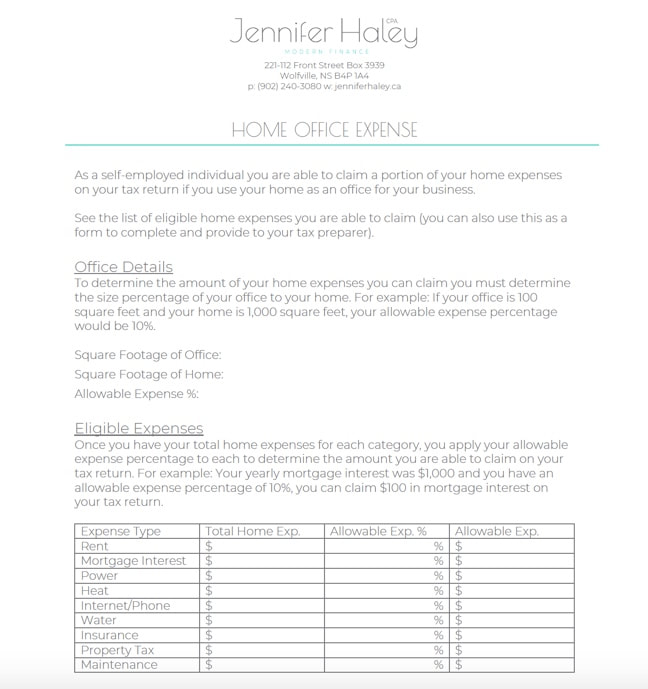

HOME OFFICE1/7/2021 Click the button below for a template that will help you organize your home office expenses for your sole proprietor tax return.

Back to Blog

TAX CHECKLIST1/6/2021 Putting off doing your taxes because you don't know where to start. Click the button below for a checklist to help you organize and gather everything you need!

Back to Blog

EMPLOYEE GIFTS11/25/2020 🎄✨Another challenge to support local when gifting to employees ✨🎄

Did you know that if you gift your employees cash or gift cards at Christmas time, you are creating a taxable benefit for them (meaning they will have to pay tax on the amount you gift!) Any gift that is cash, near cash, or non cash is a taxable benefit to employees. However CRA has created a policy which allows employees to receive certain gives for certain holidays/events without creating a taxable benefit. So let's first discuss the 3 types of gifts that are in the policy so you have an understanding how each play out.

To give another example, a movie voucher would be considered near cash as the employee can go see whatever movie they choose. However if you give them a ticket to one specific movie at a designated time, this would be considered non cash. Now, when does a gift become a taxable benefit for the employee and when are the situations that it is not? Let's get the cash and near cash gift out of the way first...if you gift an employee cash or near cash, regardless of the reason or amount it is taxable to your employee. You must add the amount to their T4 at the end of the year. There are no exceptions to this. The rules change however when you are gifting something that is non-cash. You are able to gift an employee non-cash items under a total value of $500 for special occasions like a religious holiday, birthday, wedding, or birth of a child. The $500 total is for the entire year, so you can gift an item valued at $500 for each event, it is the combined total. if you gift anything above and beyond the $500 it would then become a taxable benefit for the employee. However only the amount beyond the $500 would be a taxable benefit (Gifted items valued at $650, $150 becomes a taxable benefit). The $500 value is also based on fair market value, which means if a supplier gifted you an item (costing you $0) and you in turn gifted it to your employee (let's say it is a coffee pot that retails at $200) then you have gifted your employee $200 in value. Items of small or trivial value are not included in this totals, these would be items such as:

I hope this little explanation helped you understand the gifting policy with CRA and you are well equipped to buy your employees gifts without creating a taxable benefit for them 🎅 For more details on the policy you can visit the CRA website at: https://www.canada.ca/en/revenue-agency/services/tax/businesses/topics/payroll/benefits-allowances/gifts-awards-social-events/gifts-awards-long-service-awards.html Jennifer H. Xo

Back to Blog

HOLIDAY BUDGET11/10/2020 🎶 It's the most wonderful time of the year 🎄🎁

But with the most wonderful time of the year, often comes as the most stressful time of the year for most; mentally and financially. The first thing you need to do before anything else during the holiday season is put together a HOLIDAY BUDGET 🗒️ 💵 it is an absolute must! Most of us do put a budget together, but it usually only includes amounts for gifts. We usually forget to include the other things that can end up costing just as much as the gifts, like decorations, food for holiday dinners, snacks for the get togethers, holiday attire and beverage for the parties, and donations to local charities. So how do you put together a budget? Follow along these steps and you will come out with a full proof budget:

After you have created your budget you might realized you don't have the available funds to cover it, you may need to look at going into debt for Christmas. We always want to plan and avoid this from happening, but we need to be realistic and often debt is inevitable during the holidays (and trust me, you aren't alone!). The worst thing to do and what we must avoid is saying, "Ahh screw it, I can't afford Christmas so I am just going to have a good time and spend as I want and not keep track of it." Trust me, this mind frame will put you in debt further than you except or will be prepared for. BUT what we NEED do is control the debt. If we know ahead of time the debt we will need to create, we can manage it throughout the holidays bu sticking to our budgets and lists and after the holidays we won't be in shock and can then build a plan to manage this debt. And this is called being financially responsible (YAY!). So even if your holiday budget puts you in debt, stick to it! You will be thankful after the holidays when you open your credit card statement and see exactly what you were expecting and have a plan to manage it! Happy Holiday Financial Responsibility! Jennifer H. Xo |

||||||||

RSS Feed

RSS Feed